Alternative Ways to Calculate Credit for the Credit Invisible

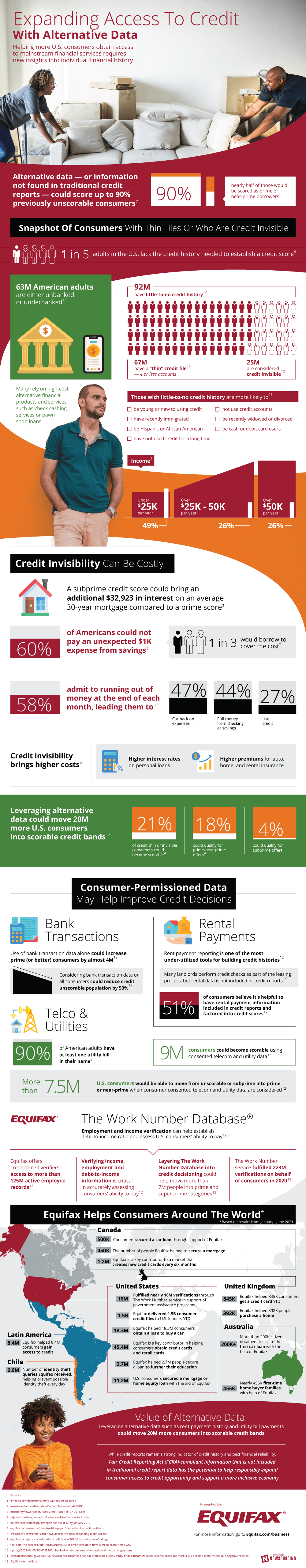

92 million Americans have little to no credit history. Their lack of credit can be due to multiple reasons from lack of experience to unfortunate life events, but what many people don’t realize is that a lack of credit history can be costly. People with little to no credit often pay higher interest on loans and have higher premiums on their home and auto insurance. This isn’t fair for people who are in situations that make it difficult to build credit, so what is the solution?

There is a new way to leverage alternative data in order to calculate credit for credit invisible people. One of the reasons that people have low or no credit is because they are more likely to pay with cash or debit cards. This means that these consumers do have a bank account and are making transactions through those accounts. These bank transactions can be used as a way to calculate credit and if bank transactions were used in this way it could lower the amount of credit unscored people by 50%.

Rental payments can also be used as alternative data. Many young people have low credit due to having no credit cards in their names, but these same young people often are living on their own in apartments. Apartment landlords charge rent from these young people, and if the rent is paid on time it should be scored in the same way as credit card payments. Rent payment is one of the most underutilized tools when calculating credit, and if rent payment was used more it could help people who are credit invisible build their credit scores. If rent and credit payments are so similar, why is it not being used to help young people calculate their credit?

Another way of calculating credit could be utility payments. Utility payments could include electric bills, phone bills, or even things like renters insurance. 90% of American adults have at least one utility bill in their name, and using that information can help invisible individuals build their credit score. 9 million people could have their credit become scorable if utility information was used in calculating credit scores.

Using these other bills and payments as an alternative way of calculating credit has a number of benefits. 21% of credit invisible or credit thin consumers could become scorable. 18% could qualify for prime or near-prime offers, and 4% could qualify for subprime offers. These alternative solutions are also only used to calculate credit scores when the consumer consents to it. This means that if people fall on hard times and have trouble paying their utility bills, they can choose to not use their payment history in their credit score but still use some of the other data.

Overall, the use of alternative data could move nearly 20 million people from credit invisible to credit scorable. Credit scores are used in almost all big purchases from cars to houses, and there need to be more opportunities for people to build their credit so they have access to these purchases. Alternative data being used to calculate credit is the solution to the amount of credit invisible people in the country.

Disclaimer: Data shown above is not financial advice and is provided by 3rd party.

Share This!