Why Inflation Is Higher Than Ever

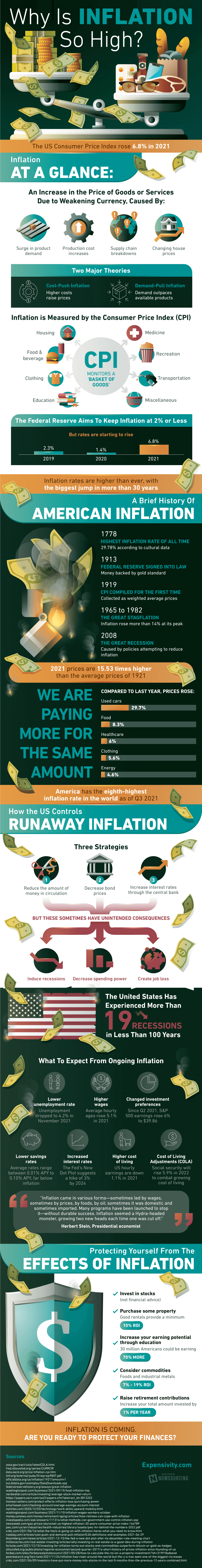

Inflation has been a part of the American economy since the birth of the country. In the past, we have seen drastic increases in inflation rates during different economic periods. Is it possible to learn from past inflation spikes, and what can we do about inflation increasing today?

The biggest inflation increase occurred in 1778 when it rose nearly 30% according to cultural data. This was due to paying back debts after the Revolutionary War and overall economic restart in the wake of a huge historical event. Another historical event that increased inflation was the Great Stagflation which occurred from 1965 to 1982. During this period inflation rose more than 14%! Something a bit more recent was the recession of 2008 in which inflation rose due to policies that originally were put in place to try and reduce it.

While these inflation spikes happened in the past, we are currently experiencing the largest inflation rise we’ve seen in decades. The pandemic caused global shutdowns which slowed the rate at which products were being produced while the demand for those products remained high. With fewer workers the labor to produce products increased which caused overall production cost increases. This occurred in all product categories which is why there was such a drastic increase in inflation.

The pandemic has continued for nearly three years now, meaning that the continuous supply and demand inconsistencies have contributed to inflation remaining high. It is estimated that social security will have to rise nearly 6% in 2022 in order to combat the growing cost of living due to inflation.

The government has strategies to control runaway inflation in times like these. Some strategies include reducing the amount of money in circulation, decreasing bond prices, and increasing interest rates through central banks. All of these strategies can have unintended consequences, however. Recessions can be induced which creates job loss and leads to a whole new set of problems like we saw back in 2008.

Since the government can’t always control inflation, it is important to know how to protect your finances during times when inflation is rising out of control. Consider investing in different stocks or purchasing property. Property has been a long-time tool for hedging against inflation since mortgage rates remain fixed. Property also provides a minimum of 10% ROI which can be very beneficial in the face of a recession. You could also consider going back to school to pursue an advanced degree. Advanced degrees can lead to better salaries and more money that is able to be saved.

Speaking of saving money, another good strategy for protecting your finances is investing more into a retirement fund. Everyone wants to retire eventually, but it can be difficult to imagine when the cost of living is so high. Consider increasing your total amount invested by only 1% a year and it can leave you in a better financial spot when you’re ready to stop working.

Inflation is an unfortunate reality within the economy. You may not like it, but it’s here to stay. The country has bounced back from worse times of economic strife, but that doesn’t mean you shouldn’t prepare yourself for times like these. Learn more about how to protect yourself against inflation in the infographic below:

Share This!